The concept of division of companies in Spain

The division of companies -as opposed to its merging- consists in the breaking up of economic forces, by separating the social heritage into two or more portions, in order to deliver each of them to other company or companies. The main purpose of the division is the decentralization of activities because, after the division, each portion will be recognised autonomous legal personality and business structure.

There are different types of divisions recognized in the Spanish Legal System by which a company can split up, resulting in the universal transfer of all or part of its social heritage by means of a single act. This structural change aims to adapt the internal structure of a company to the changing, complex and uncertain socio-economic context, for better development of its corporate purpose.

How can a company participate in a process of division?

Any legal entity interested in participating in a process of division shall fulfil the following requirements:

1. It must be a commercial entity, regarding either its corporate purpose’s nature or its corporate form (corporation, limited-liability company, limited partnership, partnership limited by shares, general partnership and grouping of economic Interests).

2. Those entities must be registered in the Commercial Registry.

3. The shares and contributions to the company must be fully paid-in.

It means that any capital calls shall be wholly paid up before the general meeting at which the spin-off agreement is achieved.

Which is the classification of division processes?

Three different types of division processes shall be distinguished:

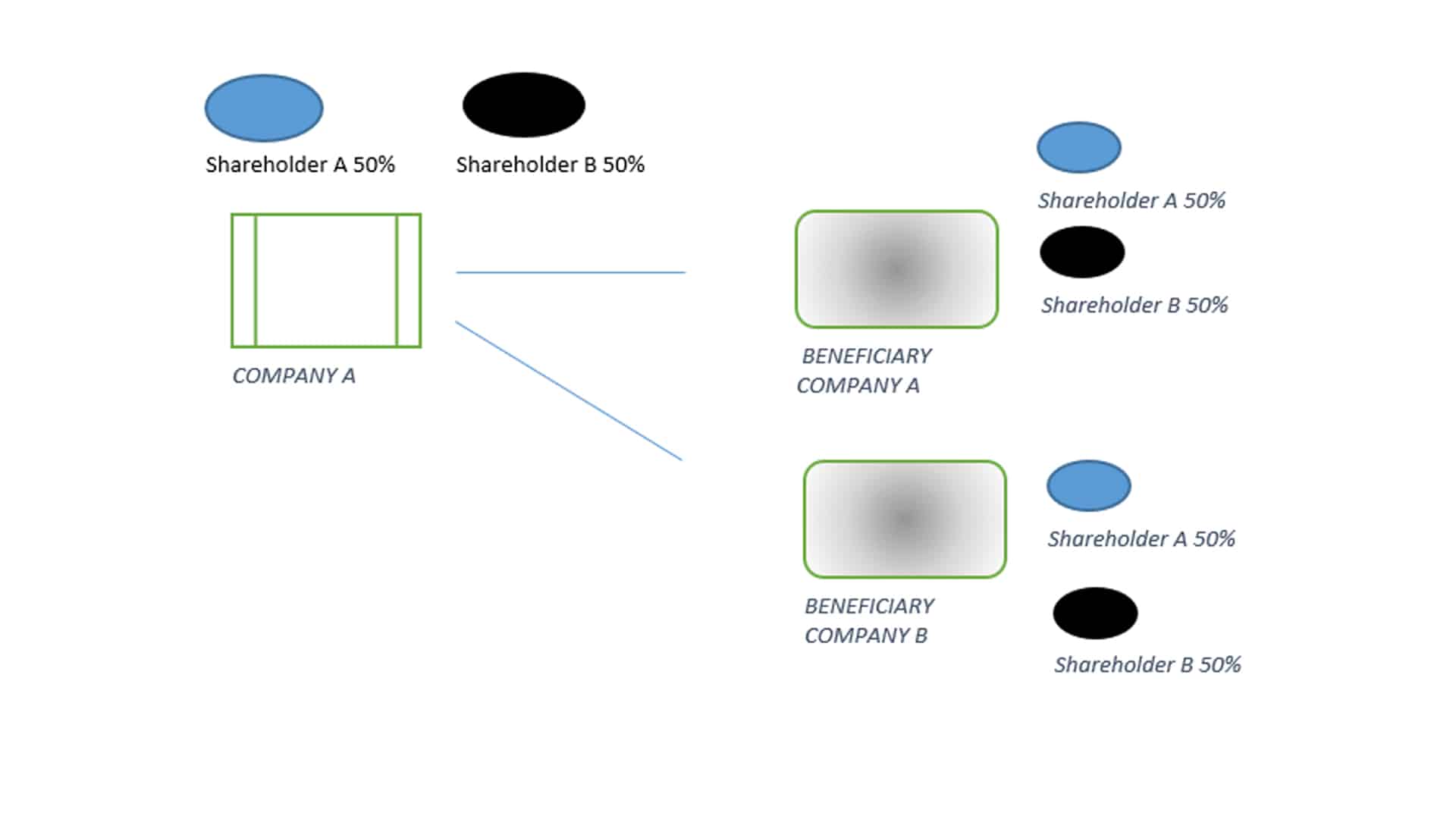

A) TOTAL DIVISON

Through this type of division, a company is dissolved without being liquidated, and its social heritage is divided into two or more portions. Thus, those portions are transferred by means of universal succession to the receiving or beneficiary companies –which can be newly created or pre-existing-, resulting in its capital increase. Finally, the shareholders of the dissolved company shall take on this status in the beneficiary company whereby they received holdings.

Moreover, it must be noted that legal corporations of those beneficiary companies may be of a different type as the dividing company.

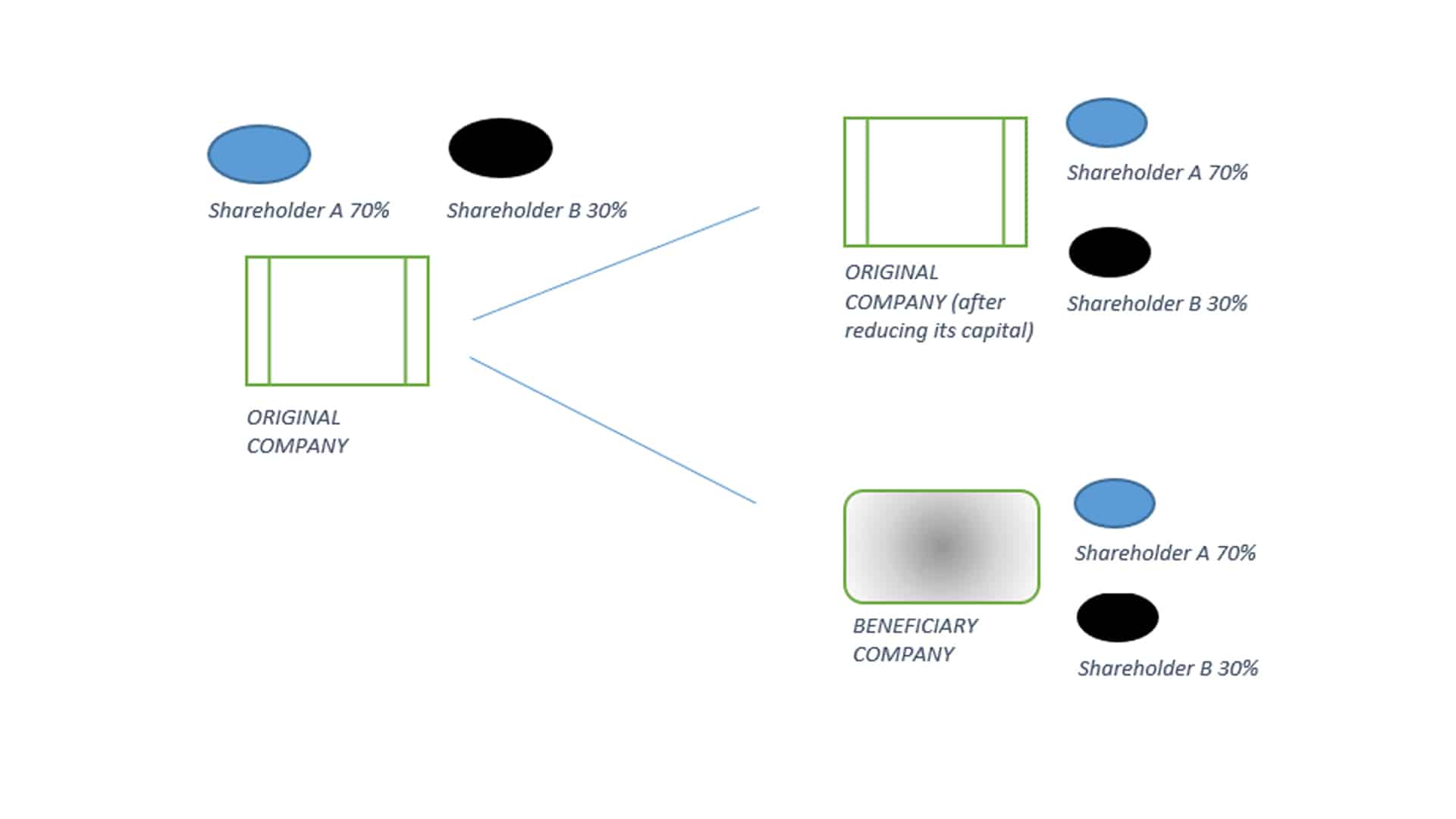

B) PARTIAL DIVISION

Consists on the transfer through universal succession of one or more portions of the heritage of a company –each of them forming an economic unit– to the beneficiary companies, with no dissolution of the former company, but reducing its capital. The shareholders of the dividing company shall take on social quotas of beneficiary companies, in proportion to their respective contributions in the original company.

Having said that, it should be addressed the issue of defining the concept of economic unit. The discussion about this concept has never been judgement free, but central case-law and legal writings advocate for the definition established in the Council Directive 90/434/EEC of 23 July 1990 on the common system of taxation applicable to mergers, divisions, transfers of assets and exchanges of shares concerning companies of different Member States. Thus, the Council Directive states that should be understood as “economic unit” a branch of activity which is transferred as a unity, and it is therefore assumed that not only assets are transferred, but also liabilities.

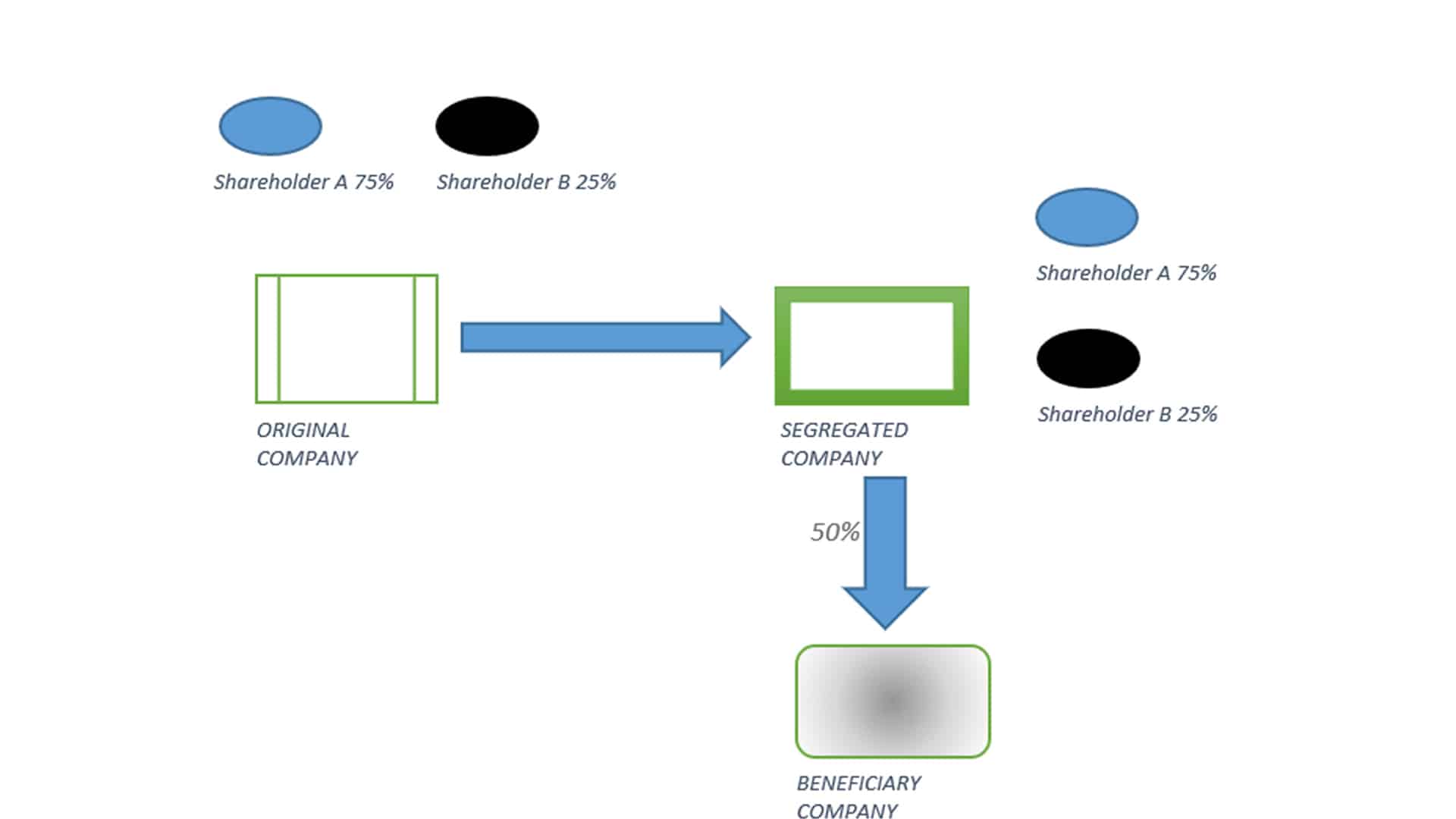

This process consists on transferring by universal succession one or more portions of the heritage of a company -each of them forming an economic unit– to one or more segregated companies. As it happens in partial division, there is no dissolution of the former company. Nevertheless, as an exchange for its contribution, the segregated companies (not the shareholders) are the ones acquiring the participating quotas of the beneficiary companies.

Finally, from the point of view of the beneficiary companies –new or existing-, we can also distinguish between three types:

A) Establishment of a new company.

B) Absorption of the heritage by an existing company, which shall increase its share capital.

C) Mixed: a portion of the heritage will be transferred to one or more newly created companies, whereas the other portion will be delivered to a pre-existing one.

María Roldán

Devesa&Calvo Lawyers