The solidarity tax on large fortunes and its interaction with the wealth tax

We are currently in the key period for filing Spain’s 2024 Income Tax and Wealth Tax (Impuesto sobre el Patrimonio, or IP) returns, which are due by 30 June. Since the 2022 tax year, however, a new companion tax has joined the calendar: the Solidarity Tax on Large Fortunes (Impuesto de Solidaridad de las Grandes Fortunas, or ISGF). Taxpayers subject to this tax must file their return (Modelo 718) between 1 and 31 July of the year following the taxable period — meaning the 2024 ISGF return is also now due.

Originally conceived as a temporary measure for 2022 and 2023, the ISGF has been extended by Royal Decree-Law 8/2023, pending a broader review of regional financing and wealth taxation. In practice, this means the ISGF remains in force for 2024 and beyond.

Who is liable to file the ISGF return?

Only taxpayers whose ISGF liability results in tax due, after applying any relevant regional deductions or allowances, are required to file a return.

The taxable event is the holding of net assets exceeding €3 million as at 31 December of the relevant tax year. That is, total assets and rights, minus liabilities, must exceed this threshold.

However, considering the €700,000 personal allowance and the additional €300,000 exemption for a primary residence, taxpayers effectively become liable when their net worth exceeds approximately €4 million, assuming they hold a qualifying main residence at maximum exemption value.

Valuation rules and exemptions under the ISGF mirror those of the Wealth Tax (IP). This underscores the importance of meeting the conditions for exemptions — particularly those applying to shares in family businesses or corporate groups.

Note that for the Wealth Tax, taxpayers must file a return even if no tax is due, where their net assets exceed €2 million.

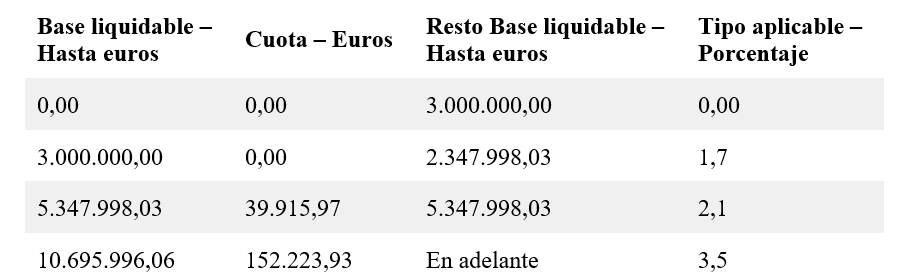

The ISGF follows a progressive scale, broadly aligned with the IP in several regions. The rates are:

Interaction between the ISGF and the Wealth Tax

Once the gross ISGF liability is calculated (and any cap based on the combined burden of income tax, wealth tax, and ISGF is applied), taxpayers may deduct the amount actually paid in Wealth Tax.

This means that in regions with Wealth Tax rates equal to or higher than the ISGF, taxpayers will generally not owe any ISGF — the resulting liability will be zero, and no ISGF return is required.

For example, in Madrid and Andalusia, the previous 100% Wealth Tax rebate has been replaced with a variable rebate, which equals the difference between what would have been due under the IP and the ISGF. This effectively redirects any tax liability to the Wealth Tax rather than the ISGF.

As a result, revenue that would have been collected under the ISGF instead accrues to the Autonomous Community through the IP, and taxpayers not affected by the ISGF continue to benefit from a full rebate on the IP.

In fact, the IP rules have been adapted to ensure that the tax paid under the IP matches what would have been owed under the ISGF.

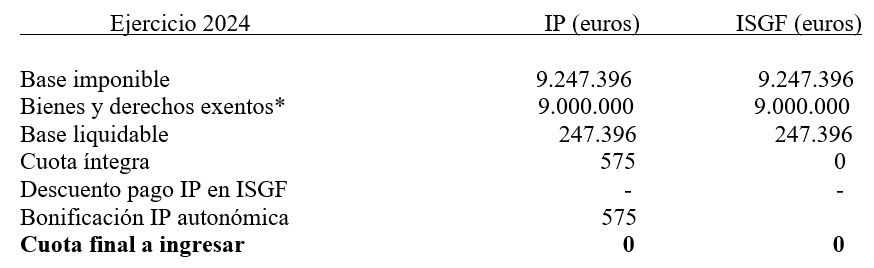

Example: Madrid resident

This includes a €300,000 exemption for the main residence, €700,000 personal allowance, and a €8 million in exempt qualifying shares in a family business

In Extremadura, which applies a 100% Wealth Tax rebate, taxpayers become liable for the ISGF from €4 million in net assets.

In Valencia, there is no rebate, but the IP rates match those of the ISGF, making it unlikely that any additional tax would be owed under the ISGF — even for very high net worth individuals.

Requirements for exemption of family business shares in the Wealth Tax

Given their significance, the key conditions for Wealth Tax exemption on family business holdings are as follows:

a) The entity’s main activity must not be the management of securities or real estate assets. Shares in companies that grant at least 5% voting rights, where the taxpayer (or group) has material and personal means of management, are not treated as financial assets — provided the company itself is not a mere holding entity.

b) The taxpayer must hold at least 5% of the company’s share capital individually, or 20% jointly with certain family members (spouse, ascendants, descendants, or second-degree relatives by blood, affinity, or adoption).

c) The taxpayer — or a qualifying family member — must actively manage the business, and receive more than 50% of their total earned income (employment, professional, or business income) from this management role.

Where part of the company’s assets are not used in business activities, the exemption only applies to the proportion of the shares that reflect business-related assets, reduced by related liabilities.

The value of exempt shares is calculated using the formula:

Value of the shares × (net value of business assets ÷ net asset value of the entity)

Conclusions

It is essential to assess whether a taxpayer may be liable for the ISGF, and how this interacts with the Wealth Tax. The impact varies significantly depending on the taxpayer’s Autonomous Community of residence.

For family businesses, it is vital to ensure compliance with exemption requirements. Any adjustment by the tax authorities — such as a disallowance or reduction of the exempt proportion — could result in substantial Wealth Tax or ISGF liabilities.

Do you need advice? Access our area related to the Large Fortunes Solidarity Tax: