Corporate groups and the tax consolidation alternative

Tax consolidation has become a key tool for many corporate groups which, as they have grown and diversified their activities across different companies, now structure their organisation through a parent company acting as the group’s holding entity.

This is the structure commonly used by well-established family groups, and it can be achieved through corporate reorganisation transactions applying a tax neutrality regime as provided under the Spanish Corporate Income Tax Act, subject to the fulfilment of certain requirements.

We can briefly review the main advantages of managing and organising different business activities and assets through a holding structure, the most significant of which are as follows:

- Channelling the various business units or lines of activity through separate subsidiaries, thereby diversifying business risks.

- Locating real estate, trademarks, or other valuable assets in the holding company or in a separate subsidiary, which leases or licenses them to the operating companies within the group.

- Financing each project separately through the holding company, which receives income from the central services rendered to its subsidiaries, interest, dividends, or capital gains generated from the sale of any such subsidiaries.

- Subject to compliance with certain requirements regarding such dividends or capital gains from the sale of subsidiaries, a 95% participation exemption for double taxation may be applied at the level of the holding company.

As can be seen, there are numerous general advantages to this corporate structure. Nevertheless, we shall focus on one particularly significant aspect: the option to apply the tax consolidation regime.

Requirements of the tax consolidation regime

This regime is voluntary and allows all companies within the group (resident in Spain) to be jointly assessed for Corporate Income Tax, thereby eliminating individual taxation.

To qualify, the parent company must hold, directly or indirectly, at least 75% of the share capital of its subsidiaries and must possess the majority of voting rights.

The election to apply the regime must be approved by the Board of Directors or equivalent governing body of each of the companies forming the tax group, and must be adopted and notified to the Tax Authorities before the start of the financial year in which it is to take effect. Once adopted, the regime remains in force indefinitely for subsequent financial years unless expressly revoked.

The taxable person becomes the tax group itself, represented by the parent company, which is responsible for filing the consolidated Corporate Income Tax return, including a consolidated balance sheet, a consolidated profit and loss account, and the corresponding tax computation showing the final tax payable or refundable, as applicable.

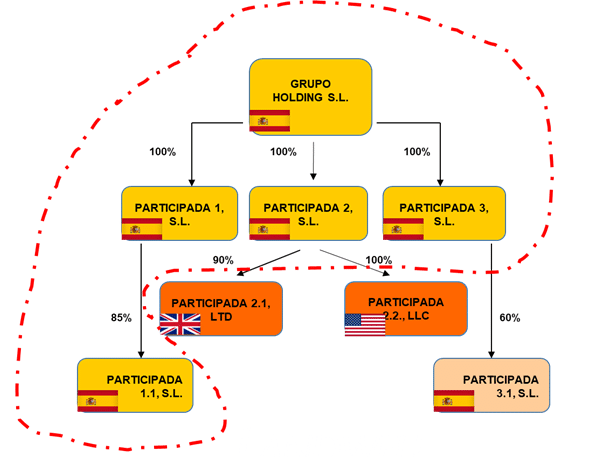

For example, a corporate group with its parent holding company established in Spain and several subsidiaries both in Spain and abroad (e.g. the UK, USA) would have the following scope for tax consolidation purposes in Spain:

All Spanish resident companies in which the parent company directly or indirectly holds at least 75% would be included within the consolidation perimeter.

Advantages of applying the tax consolidation regime

Some of the main advantages of this regime are:

- Taxation based on the net profit of the group, allowing the offset of losses incurred by one company against the profits of others.

- Full utilisation of all tax losses and deductions available within the group.

- Elimination of intra-group profits arising from internal transactions (fixed assets, inventories, services, dividends).

- No withholding tax obligations on interest, dividends, or rental income paid between companies within the group.

- Reduction of potential tax contingencies arising from transfer pricing issues, and no obligation to prepare transfer pricing documentation for intra-group transactions.

It should be noted that, since the 2023 tax year, a limitation has been introduced in the calculation of the group’s taxable base: only 50% of individual tax losses may be included in the group’s tax base, with the remaining 50% to be incorporated in equal parts over the following ten tax periods (with corresponding negative adjustments).

This measure was initially approved on a temporary basis for the 2023 tax year but has been extended to the 2024 and 2025 tax years by Law 7/2024 of 20 December.

Conclusions on tax consolidation

As we have seen, the application of this regime offers significant advantages, some of which are of very practical relevance, such as the exemption from the obligation to prepare transfer pricing documentation—a formal requirement that the Spanish Tax Authorities are increasingly scrutinising, and which many companies fail to comply with due to its complexity, thereby exposing themselves to potential penalties.

In short, with the end of the financial year approaching, it may be an opportune moment to thoroughly assess whether the application of the tax consolidation regime would be beneficial for your corporate group from 2026 onwards. If so, there is still time before the end of 2025 to prepare and adopt the relevant resolutions, as we have seen, given the many advantages it provides.

Do you need advice? Access to our area related to corporate groups and the tax consolidation alternative: