The capitalisation reserve deduction under Corporate Income Tax: updates, practical challenges, and recommendations

What is the capitalisation reserve deduction in Corporate Income Tax?

The capitalisation reserve deduction is a tax incentive that allows Corporate Income Tax (CIT) payers to reduce their taxable base by a percentage of the increase in their equity, provided that two main conditions are met:

The increase must be maintained for a set period

A non-distributable (restricted) reserve must be created

This incentive is regulated under Article 25 of Law 27/2014 on Corporate Income Tax (LIS) and can only be applied by entities subject to:

The general CIT rate of 25% or 23%

The higher rate of 30% (applicable to credit institutions or hydrocarbon entities)

The special regimes for SMEs and microenterprises

To benefit from the deduction, companies must meet the following requirements:

Increase their equity during the tax period

Maintain the increase for three years, unless accounting losses occur

Allocate a non-distributable reserve for the amount of the deduction, which must be clearly labelled and shown separately on the balance sheet

What’s new for the capitalisation reserve deduction from 2025?

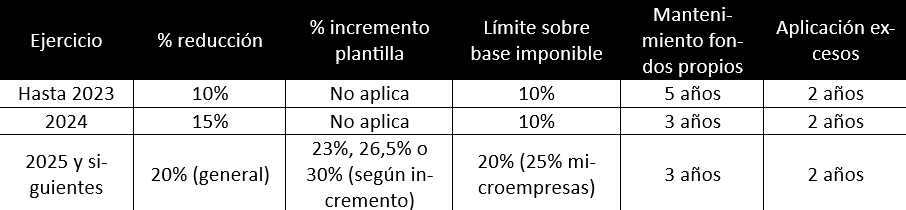

From the 2025 tax year onward, this fiscal incentive introduces significant changes, particularly to the deduction percentages and limits on its application.

New deduction percentages

The standard deduction rate will rise to 20%. However, it may increase based on the growth in the company’s average workforce:

23% if the workforce grows between 2% and 5%

26.5% if growth exceeds 5% but remains below 10%

30% if growth exceeds 10%

This increase must be sustained for three years following the tax year-end.

New limit on the taxable base

The deduction will be capped at 20% of the positive taxable base, calculated before:

- The capitalisation reserve deduction itself

- Adjustments for certain non-deductible expenses

Carry-forward of prior years’ tax losses

For microenterprises (turnover under €1 million), this limit is increased to 25%.

Summary table: capitalisation reserve deduction (2025 onward)

Key challenges in applying the capitalisation reserve deduction

While the mechanism appears straightforward, several practical issues can arise. Here are three critical areas of concern:

1. The non-distributable reserve: formal requirement or substantive condition?

Although it may seem a mere formality, the Spanish Tax Agency (AEAT) treats this requirement as substantive—its absence may invalidate the deduction.

Conflicting case law:

Catalonia High Court (2024): allowed the deduction despite formal deficiencies

Andalusia High Court (2025): considered the reserve a crucial requirement for tax control

Recommendation: Strictly comply with this requirement unless/until the Supreme Court issues a definitive ruling.

2. When must the reserve be allocated?

The law suggests that the reserve must be allocated before the tax year ends (e.g. before 31 December).

However, the tax authority’s interpretation allows it to be created:

In the following financial year

Charged against voluntary reserves

Within the legal deadline for approving annual accounts

Binding rulings supporting this approach: V4127-15 and V3154-16

Recommendation: If possible, allocate the reserve before year-end to minimise risk of disputes.

3. Business restructurings

In mergers or demergers applying the special tax neutrality regime, the beneficiary company inherits the obligation to maintain the reserve.

Eliminating the reserve from accounting records does not trigger clawback (e.g. ruling V5233-16)

If the transaction does not benefit from the special regime, disposal of the reserve will trigger a tax adjustment

Conclusion and legal advice

The capitalisation reserve deduction can lead to substantial Corporate Income Tax savings, but it requires technical compliance and up-to-date knowledge of legislative changes and administrative interpretations.

If your company wants to take advantage of this incentive, Devesa Abogados can assist you in assessing your situation and meeting all legal requirements to ensure risk-free implementation.

Do you need advice? Access our area related to the reduction for the capitalisation reserve in the Corporate Tax: